You can contribute a total of up to $27,500 (concessional contributions cap) before tax each financial year from 1 July 2021. Before-tax contributions are generally taxed at 15%, unless you: earn more than $250,000 p.a1. haven't given your TFN to your super fund. go over the concessional contributions cap.. When you're retired. Super is money set aside for you to use when you've reached retirement age and have retired. Find out more about accessing super when you retire. Early access to your super. In limited situations you can get access to your super early. Find out about getting early access to your super on the ATO website.

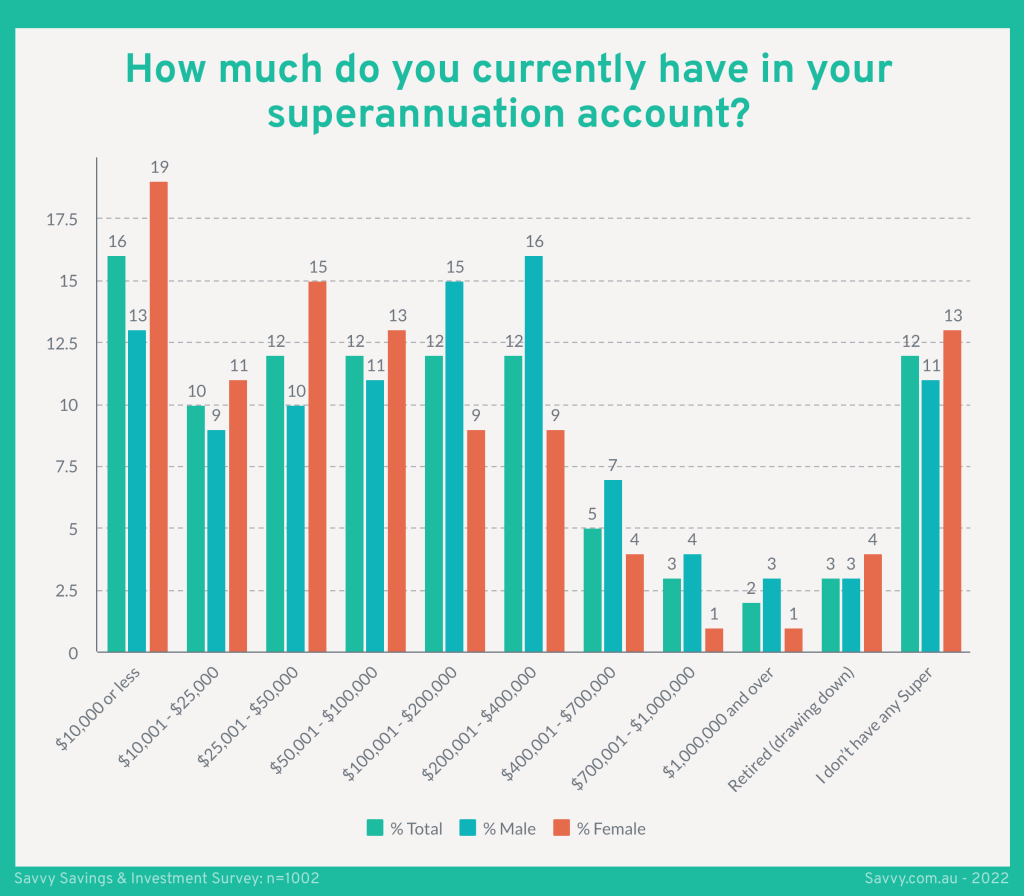

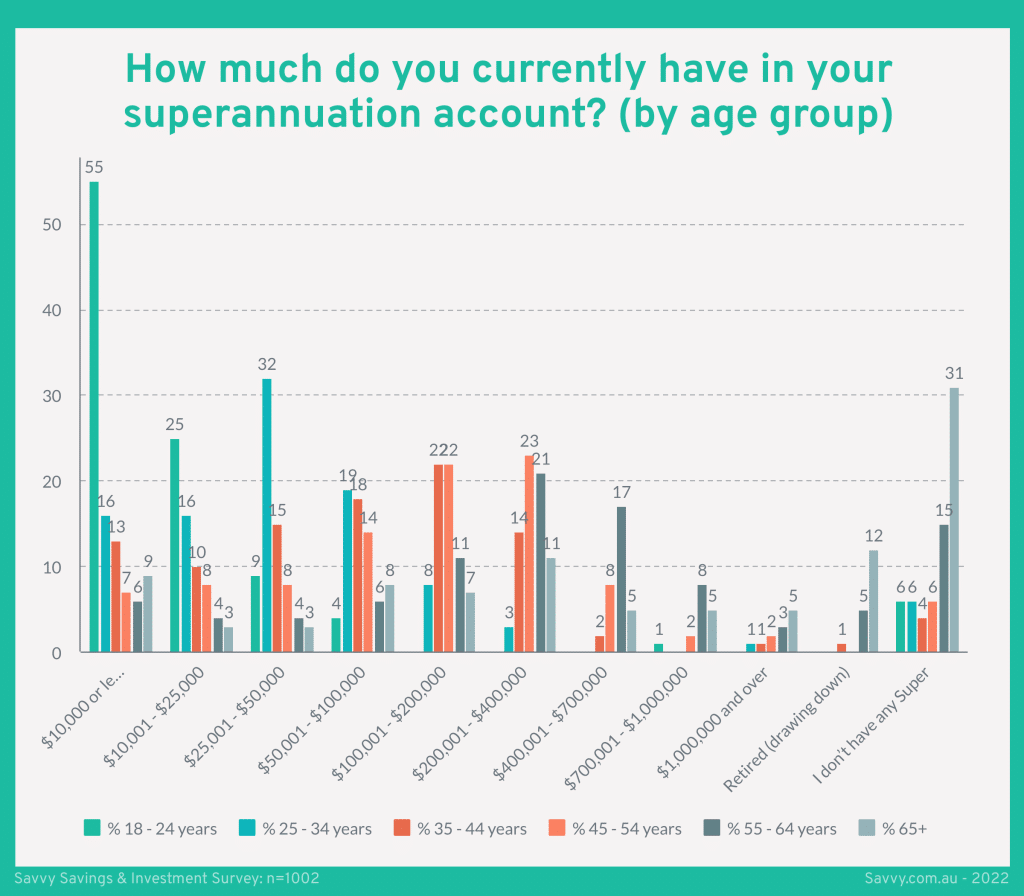

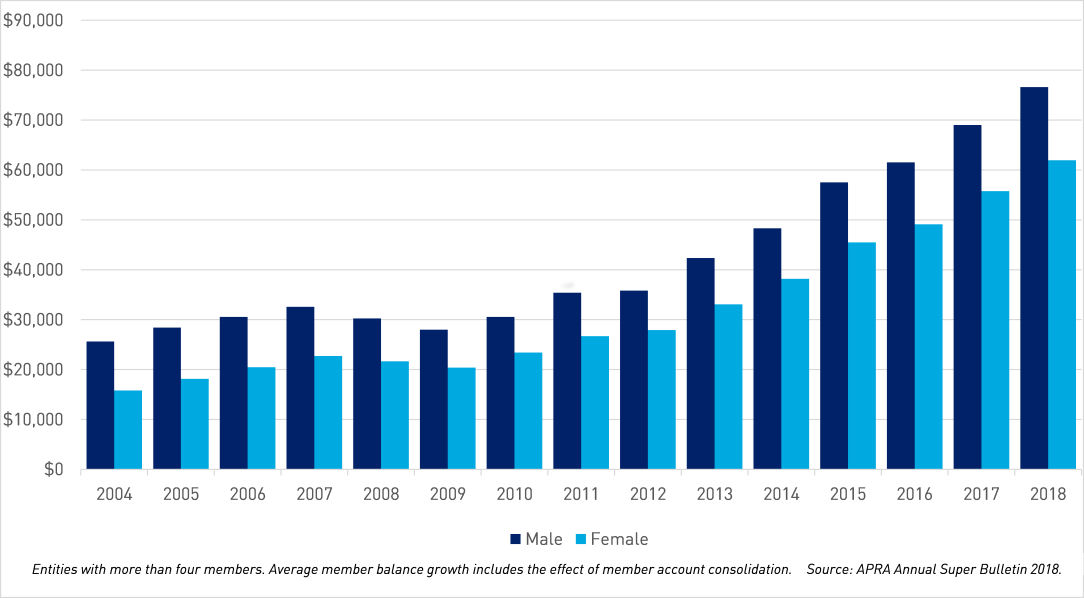

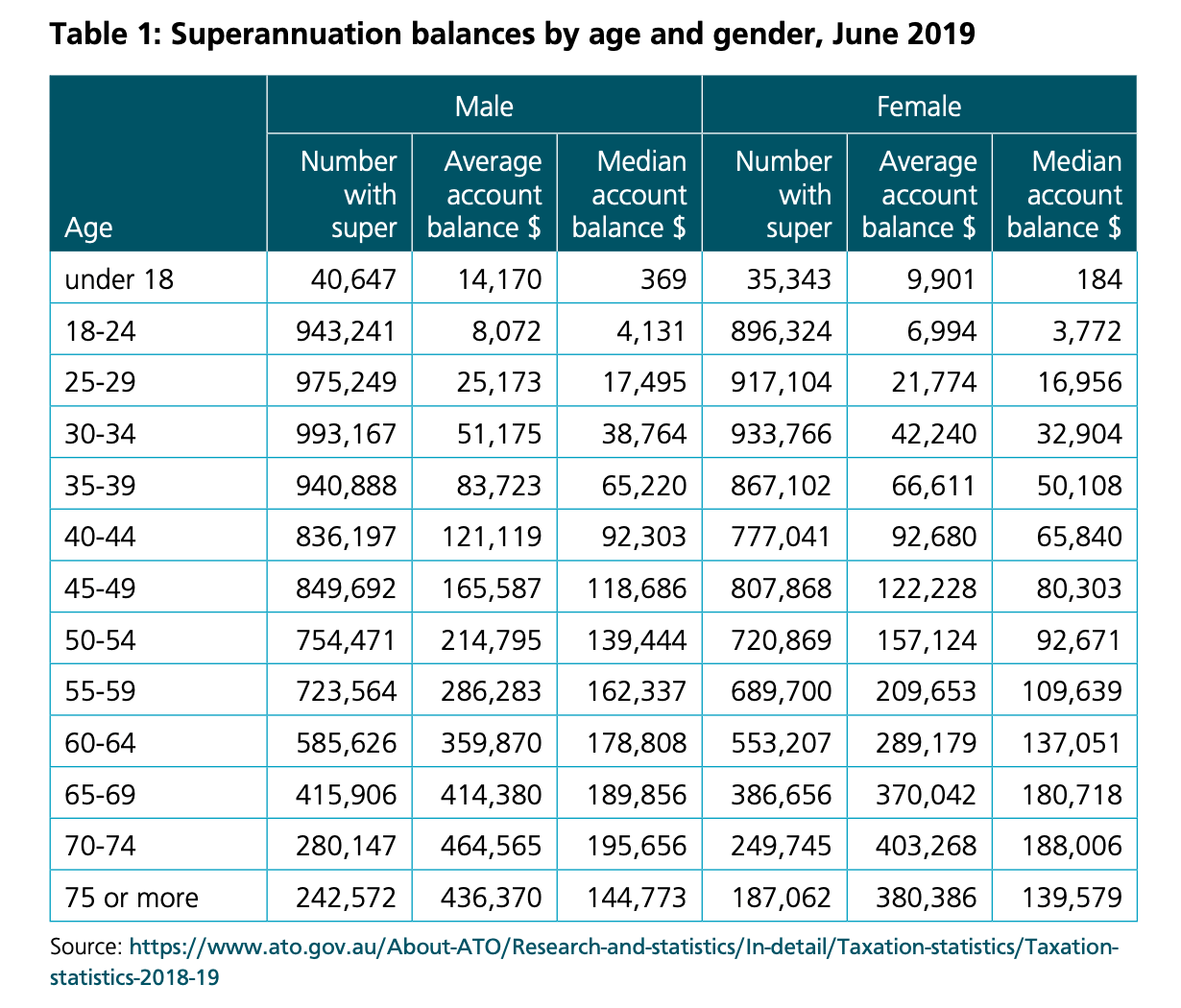

Superannuation in Australia, 2022 Survey Men Twice as Likely as Women to Have a Higher Balance

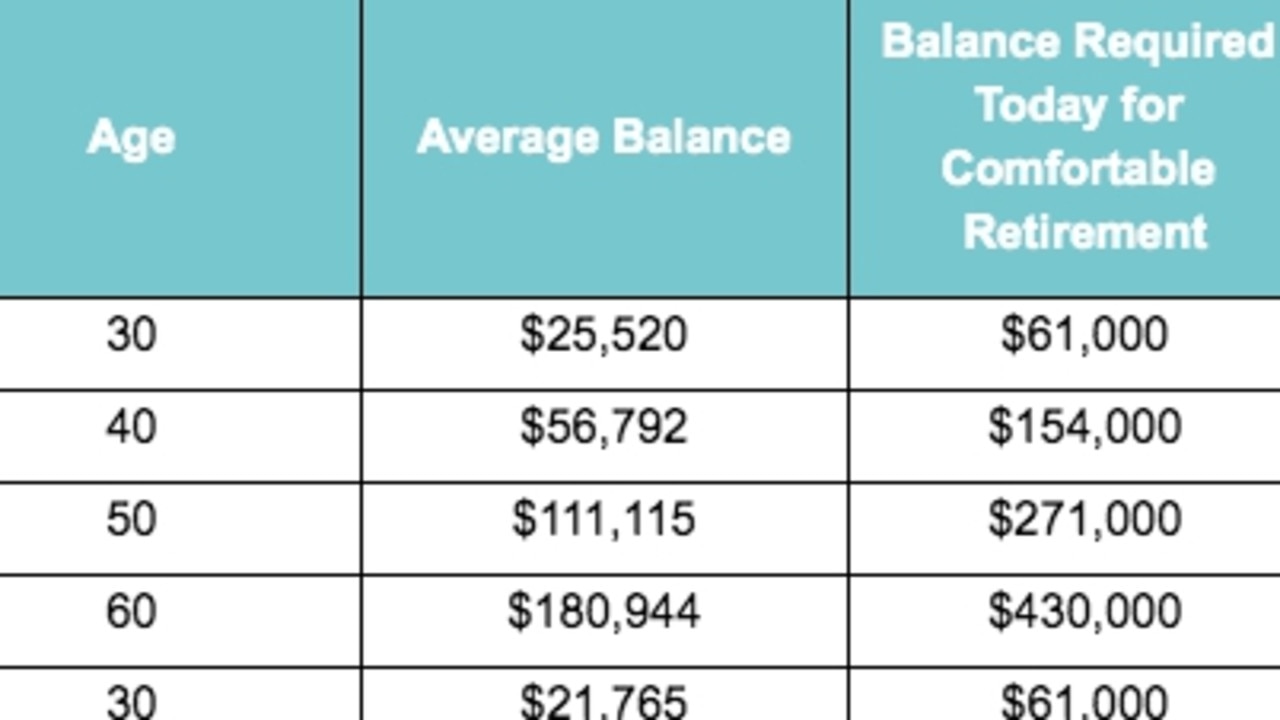

How much superannuation you should have based on your age — Australia’s leading

Superannuation withdrawal scheme cost millions of Aussies 3644 — Australia’s

The (reassuring) truth about retirement • Inside Story

What is an Australian Superannuation? Australia packing list, Australia travel, Moving to

Superannuation in Australia, 2022 Survey Men Twice as Likely as Women to Have a Higher Balance

Tip 79+ about australia superannuation calculator hot NEC

Superannuation en Australia Todo lo que debes saber

Australian superannuation mergers cut number of funds by half in a decade Superannuation The

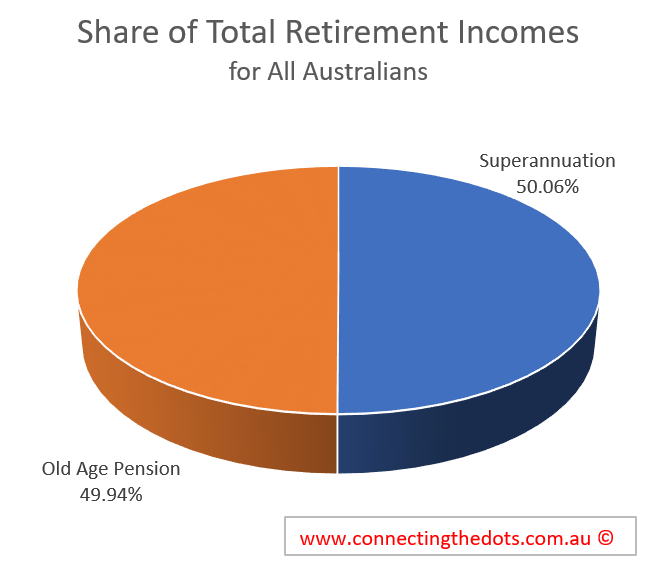

Australian Retirement ConnectingTheDots

How much do you know about superannuation?

What is superannuation? Australian Retirement Trust

comparison How rich are you compared to other Australians?

Superannuation changes from 1 July set to boost retirement savings of millions of Australians

Notes on Australian pension and superannuation system My technical blog

_FA Income WEB.jpg?itok=JPDv5Wo_)

and work Census, 2021 Australian Bureau of Statistics

Superannuation in Australia a timeline APRA

You're an average Australian what should your super balance be now? Stockhead

What is Australian superannuation system and why individuals should focus on growing their

Australia’s average fulltime salary now above 90,000 Daily Telegraph

If you're age 55 to 59. Your income payment has two parts: taxable — taxed at your marginal tax rate, less a 15% tax offset; tax-free — you don't pay anything more; If you're age 55 or younger. You can usually only access your super if you experience permanent incapacity. If this happens, you'll be taxed the same as people aged 55 to 59.. Where an ordinary wage earner is allowed an $18,200 tax-free threshold, if your income as a senior couple is less than $28,974 each or $57,948 combined, you won't be asked to pay any tax.